# Evaluating the Ratings of Financial Education Tools

In today’s ever-complex financial world, the right educational tools can play a pivotal role in helping individuals make informed decisions about their finances. From budgeting apps to investment courses, the market is flooded with resources aiming to enhance financial literacy. This article delves into how various financial education tools are rated, offering insights to help readers identify the best options for their learning journey.

##

Understanding Financial Education Tools

Financial education tools encompass a wide range of resources designed to improve financial literacy. These can include online courses, mobile apps, books, podcasts, and interactive websites, each offering unique approaches to teaching financial concepts. The primary aim is to provide users with the knowledge and skills necessary to manage their finances effectively, covering topics such as saving, investing, budgeting, and debt management.

##

Criteria for Rating Financial Education Tools

To assess the effectiveness and value of financial education tools, various criteria are applied. These typically include usability, accessibility, content quality, applicability, and the credibility of the information provided. User reviews and expert opinions also play a critical role in determining the overall rating of a financial education tool.

###

Usability

How user-friendly is the tool? Is the interface intuitive for the target audience, whether they’re beginners or more advanced users?

###

Accessibility

Can the tool be easily accessed by a wide range of users, including those with disabilities? Is it available on multiple platforms, such as web and mobile?

###

Content Quality

Is the content accurate, up-to-date, and comprehensive? Does it offer actionable insights that users can apply to their financial lives?

###

Applicability

How applicable are the lessons from the tool in real-life financial situations? Can users easily implement the strategies and tips provided?

###

Credibility

Who produces the content, and what are their qualifications? Is the information based on solid financial principles and evidence?

##

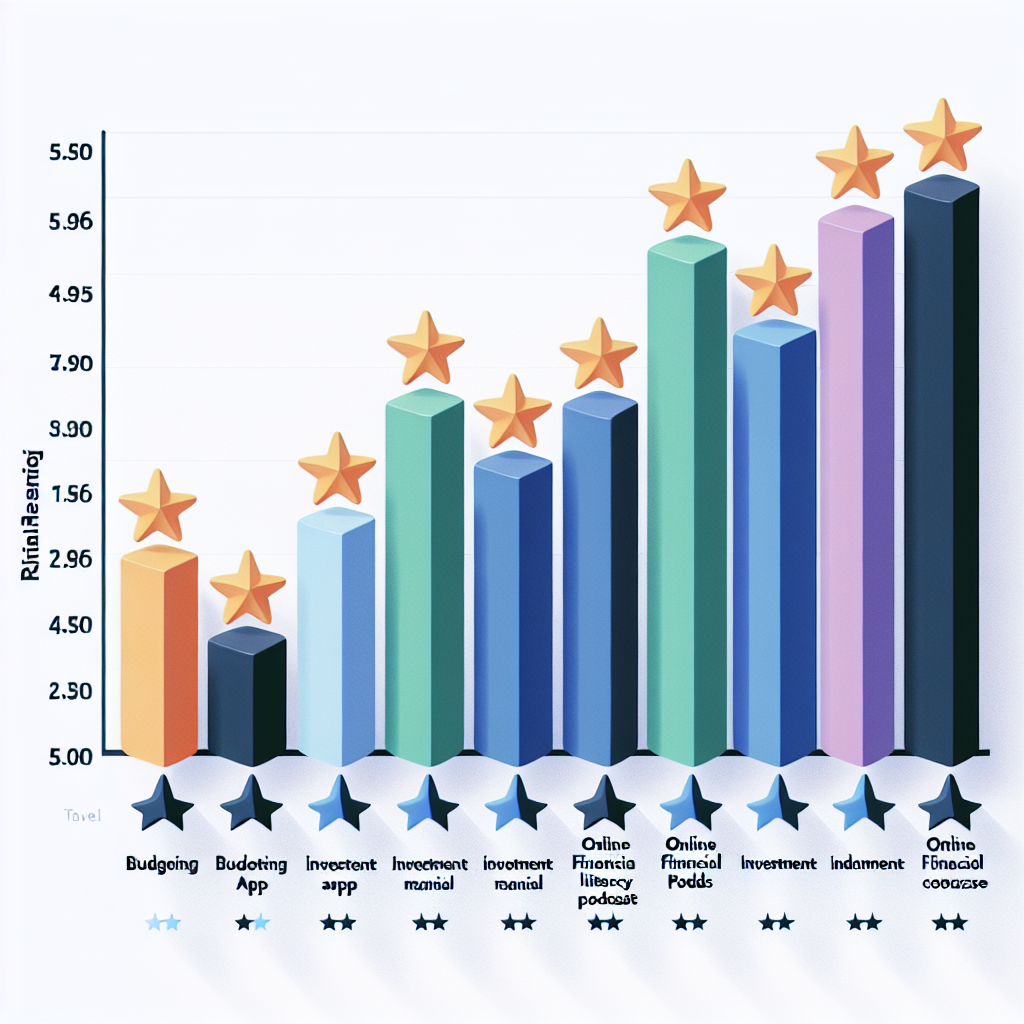

Top-Rated Financial Education Tools

Based on the criteria outlined above, several financial education tools have received high ratings from users and experts alike. Here are a few standout resources:

###

Budgeting Apps: You Need A Budget (YNAB)

YNAB is highly rated for its user-friendly design and practical approach to budgeting. It emphasizes giving every dollar a job, helping users gain control over their spending and save more effectively.

###

Online Courses: Coursera’s Financial Literacy

This course is praised for its comprehensive coverage of financial concepts, from the basics of financial planning to more advanced investment strategies. It’s accessible to learners of all levels and offers valuable knowledge that can be applied immediately.

###

Investment Tools: Robinhood

Although primarily a trading platform, Robinhood offers educational content that demystifies investing for beginners. It’s rated well for its simplicity, making it an excellent tool for those new to investing.

###

Books: “The Total Money Makeover” by Dave Ramsey

This book is a favorite for its straightforward approach to managing personal finances. Ramsey’s steps to financial freedom are clearly laid out, making it a practical guide for readers looking to overhaul their financial habits.

##

Conclusion

When choosing a financial education tool, it’s crucial to consider your learning style, financial goals, and the specific financial topics you’re interested in. By using the ratings criteria as a guide, you can select resources that best match your needs and help you advance on your path to financial literacy and independence. Remember, the journey to financial savvy is ongoing, and the right tools can make all the difference in achieving your financial objectives.