Investment Strategies for High Inflation Environments

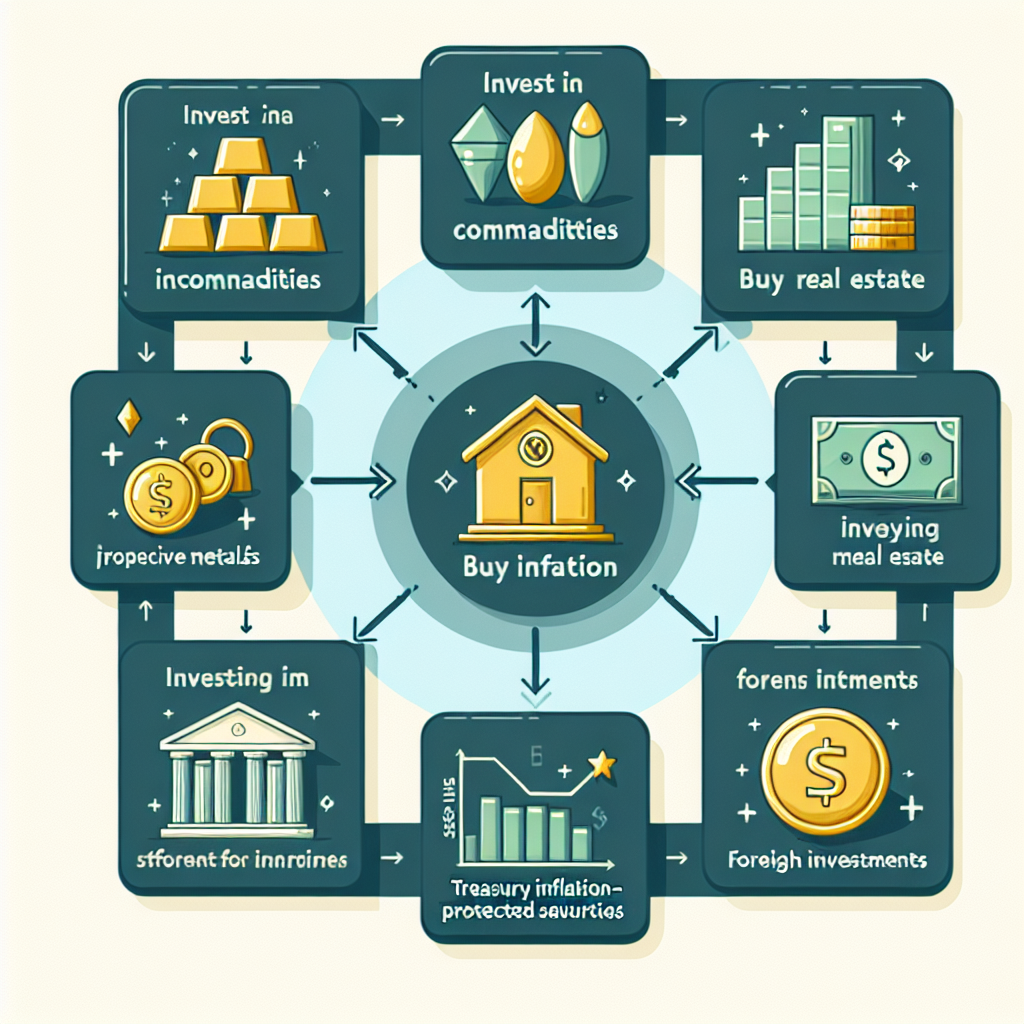

Inflation can rapidly erode purchasing power and diminish the real returns of investments. During high inflation periods, investors often scramble to adjust their portfolios to hedge against the detrimental effects of rising prices. Understanding how to navigate these tumultuous times can help in preserving and potentially growing your investment value. Below, we discuss various strategies to consider.

Understanding Inflation and Its Impact

Before delving into the strategies, it’s crucial to understand what inflation entails and its potential impact on investments. Inflation refers to the rate at which the general level of prices for goods and services is rising, and, subsequently, purchasing power is falling. Central banks attempt to limit inflation, and avoid deflation, to keep the economy running smoothly. However, during high inflation periods, investors need to be particularly savvy with their investment choices to mitigate the adverse effects.

Real Assets: Tangible Inflation Protection

Investing in real assets is a classic strategy for inflation protection. Real assets include physical commodities like gold, real estate, and other tangible items that tend to retain value over time.

Gold and Precious Metals

Gold has traditionally been seen as a hedge against inflation. Its value often rises when the real return on fixed income and equities declines, making it a go-to asset during inflationary periods.

Real Estate Investments

Real estate often acts as a good inflation hedge because property values and rents typically increase during inflationary times. Real Estate Investment Trusts (REITs) can be a more liquid way to invest in real estate.

Equities: Selective Approach

While equities can be volatile during inflationary periods, certain sectors may outperform others, offering protection against inflation.

Equities in Companies with Pricing Power

Investing in companies with strong brand loyalty or essential products that allow them to pass increased costs directly to consumers can be a wise move. These companies can maintain, or even grow, their margins during high inflation.

Dividend-Growing Stocks

Companies that have a history of paying and increasing dividends might offer an inflation hedge, as they can provide a growing income stream that outpaces inflation.

TIPS and I Bonds

Treasury Inflation-Protected Securities (TIPS) and I Bonds are designed to offer protection against inflation. Both are backed by the U.S. government and adjusted according to the inflation rate, ensuring that they maintain their real value over time.

Treasury Inflation-Protected Securities (TIPS)

TIPS are marketable securities whose principal is adjusted by changes in the Consumer Price Index. They guarantee a real rate of return, making them a stable choice for protection against inflation.

I Bonds

Series I savings bonds are low-risk savings products that earn interest plus an inflation rate that’s adjusted twice a year. They’re an accessible way for individual investors to hedge against inflation.

Commodities and Cryptocurrency

Apart from traditional investments, commodities like oil and agricultural products, and even some cryptocurrencies, can offer inflation hedging properties.

Commodities as Inflation Protection

The prices of commodities tend to rise with inflation, making them a suitable hedge. Direct investment in physical commodities can be complex, but commodity-focused ETFs offer a more accessible option.

Cryptocurrencies

While highly volatile and debated, some view cryptocurrencies like Bitcoin as digital gold due to their limited supply. Caution should be exercised due to their speculative nature and potential for significant price swings.

Strategic Diversification

Diversification remains a cornerstone of robust investment strategy, especially in high inflation environments. A well-diversified portfolio across asset classes like stocks, bonds, real assets, and even currencies can mitigate risks and safeguard against inflation’s unpredictable impacts.

Conclusion

Inflation can pose a significant risk to the value of an investment portfolio. However, by employing strategies such as investing in real assets, selecting equities judiciously, utilizing TIPS and I Bonds, exploring commodities and cryptocurrencies, and maintaining portfolio diversification, investors can navigate through high inflation periods. It’s essential to adapt investment strategies to changing economic environments and consider professional financial advice tailored to your specific situation.