# Elliott Wave Analysis Methods

Elliott Wave Theory is a method of technical analysis that traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Developed by Ralph Nelson Elliott in the 1930s, this theory asserts that stock market prices unfold in specific patterns, which practitioners today apply to all forms of market data. Here’s a deeper look into the Elliott Wave analysis methods.

Understanding the Basics

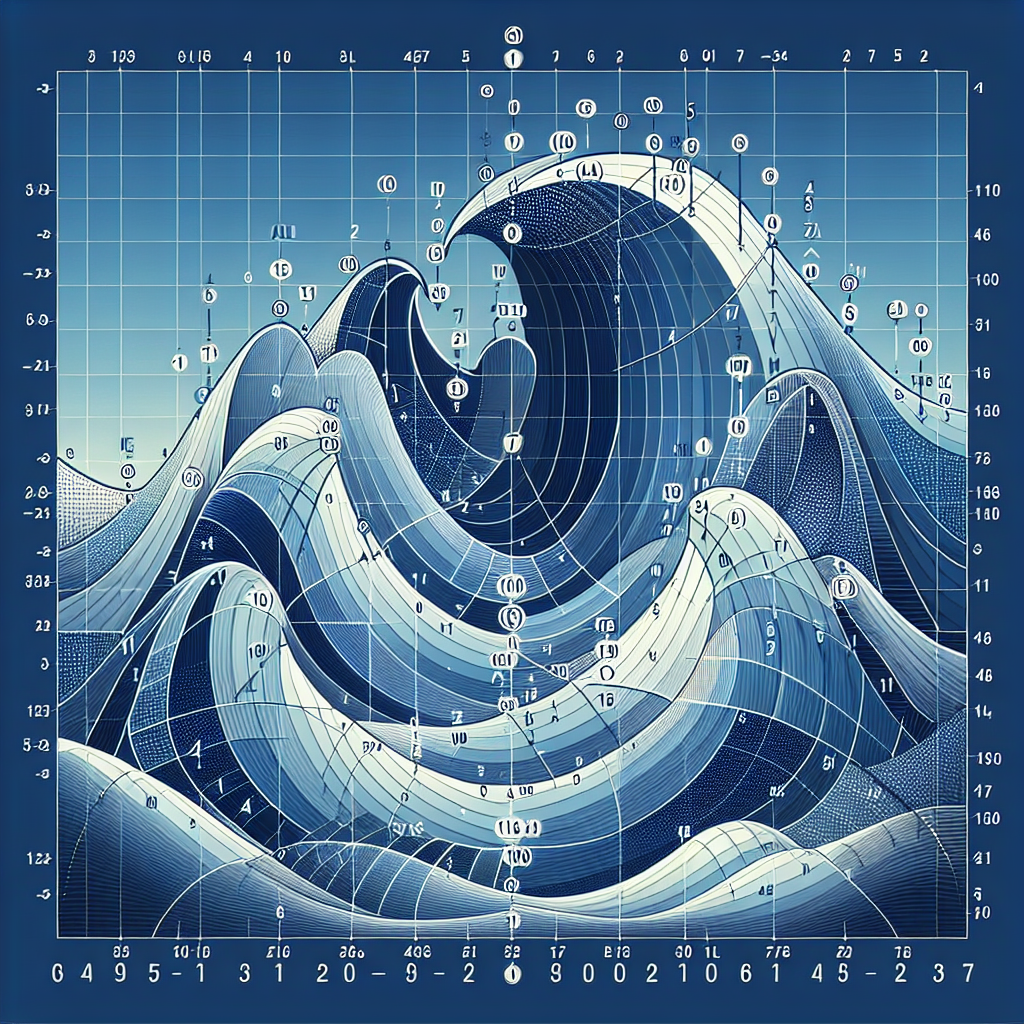

Elliott Wave Theory suggests that market movements follow a natural rhythm of psychological waves: five in the direction of the main trend followed by three corrective waves (a 5-3 move). This 5-3 move then becomes two subdivisions of the next higher wave move. The waves are fractal, meaning the structure is self-similar on different timescales. Understanding this basic structure is crucial for applying Elliott Wave analysis effectively.

The Wave Patterns

Elliott identified several patterns within the “waves” that the market produces in its price movements. These can be broadly categorized into motive waves, which drive the market, and corrective waves, which move against the primary trend.

Motive Waves

Motive waves push the market in the direction of the prevailing trend and are typically composed of five sub-waves, numbered as 1, 2, 3, 4, and 5. Waves 1, 3, and 5 are impulse waves, which move in the direction of the trend, while Waves 2 and 4 are corrective waves, which move against it.

Corrective Waves

Corrective waves, on the other hand, work against the primary trend and are typically composed of three sub-waves, labeled A, B, and C. These waves can take various forms, including flats, zigzags, and triangles.

Applying Elliott Wave Analysis

The application of Elliott Wave analysis involves several steps, from identifying the wave count to using it for trading decisions. Here’s a basic approach:

Identifying The Wave Count

Identifying the current position of waves in the market cycle is crucial. This involves distinguishing between impulse and corrective wave patterns, and understanding where the current price action lies within these patterns.

Wave Prediction

Once the current wave count is identified, traders use the patterns to predict future market movement. For example, if a trader identifies the completion of a corrective wave, they might predict the beginning of an impulse wave.

Entry and Exit Points

Traders use their analysis to determine strategic entry and exit points. For instance, entering at the start of an impulse wave and exiting at its peak could maximize profitability.

Challenges and Considerations

While Elliott Wave analysis can be a powerful tool, it also presents challenges. Its subjective nature means that different analysts can interpret the wave patterns differently. Additionally, it works best when combined with other forms of analysis, such as technical indicators, to confirm trends and predictions.

Conclusion

Elliott Wave analysis offers a framework for understanding market movements and making predictions. Its effectiveness comes from its ability to identify the repetitive patterns in prices caused by collective investor psychology. By combining a thorough understanding of wave patterns with other analysis tools, traders can use this method to seek out potential trading opportunities in various market conditions. However, like any analytical method, it requires practice, patience, and a balanced approach to overcome its challenges and capitalize on its benefits.